PAY ATTENTION TO WHAT YOU VALUE

- Derek Hagen

- May 2, 2024

- 5 min read

❝We can be blind to the obvious, and we are also blind to our blindness.❞ -Daniel Kahneman

There seems to be a growing belief that economics is a field that looks at what a perfectly rational person would do, and behavioral economics looks at what people actually do. Economics, though, is a field that views people as optimizing individuals, without specifying what each individual optimizes. Recognizing that everyone is different isn't new, nor is it outside the field of economics. It's just that it's often underneath conscious awareness.

ECONOMICS BASICS

As an economics graduate, I can safely say that most of economics is nothing more than various ways of saying "supply and demand." Markets are defined in economics as a place where people come together to buy and sell things. Many people think of the stock market when they think of "markets." That would be intuitive because that's what the media is generally focused on when they talk about markets. The stock market is a place where people (traders) come together to buy and sell stocks.

But there are other markets including other financial markets - bond markets, commodity markets, and so on. There are other nonfinancial markets, too, like the market for labor, housing, or Beanie Babies.

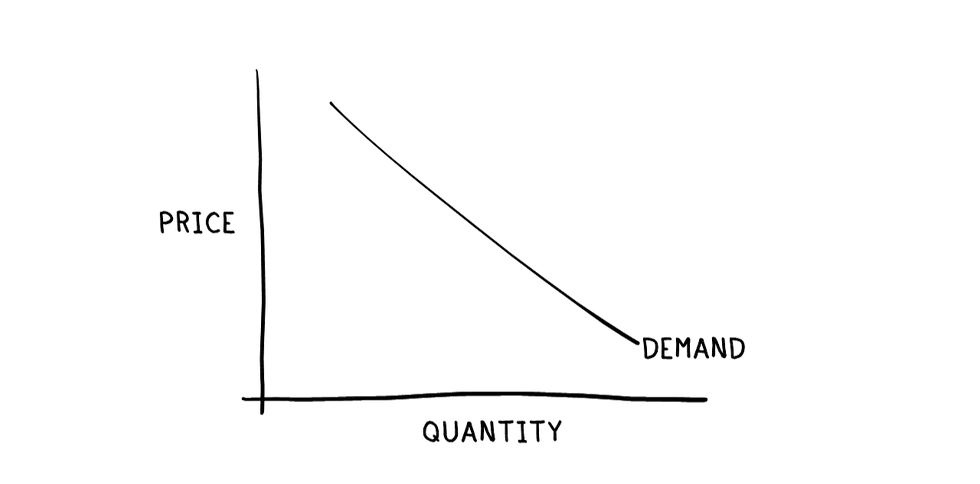

Markets are made up of many people, some of whom are looking to buy. In economics speak, they demand whatever the market offers. People will generally demand fewer goods and services as the price goes up. Conversely, they demand more goods as the price goes down.

Thus, a demand curve looks something like this.

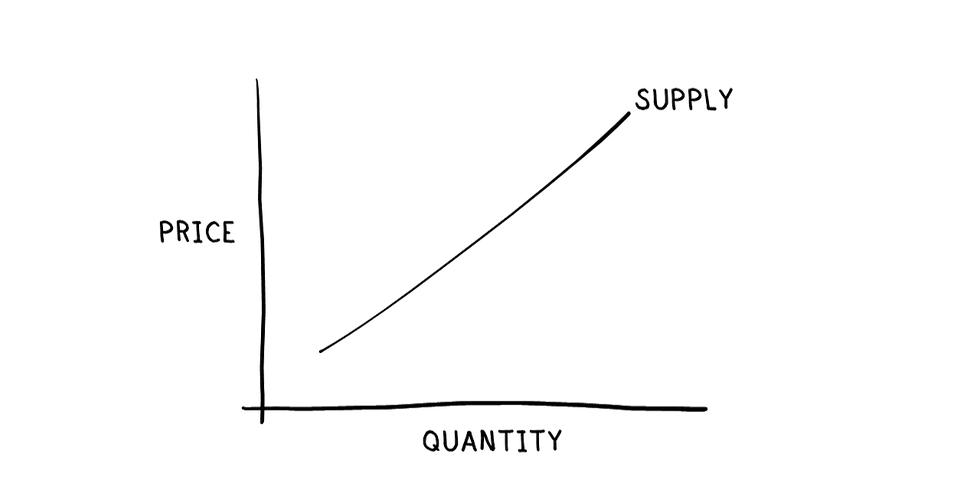

Others in the marketplace are looking to sell to those demanders. In the language of economics, they are suppliers. Generally speaking, people will want to sell more when the price is high, and sell less when the price is low.

So, a supply curve looks like this.

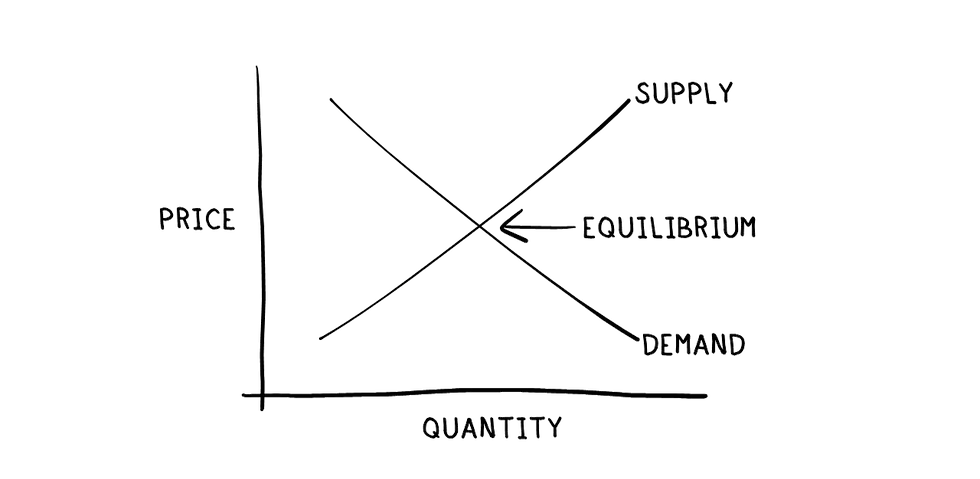

If you take supply and demand together, you get a pretty good read on the market price, which is the place where the supply curve and demand curve intersect. Economists call this the equilibrium.

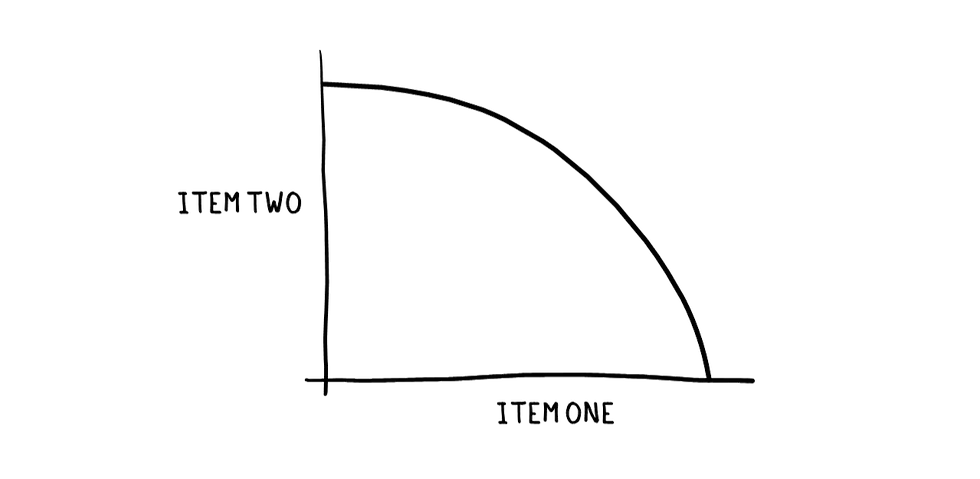

That generally describes the market for one good or service, but you and I are in different markets at different times. I might be in the market for concert tickets and dinners out. These are only two things I might demand, but my wants could technically be infinite. At the same time, my resources - money, time, and energy - are limited.

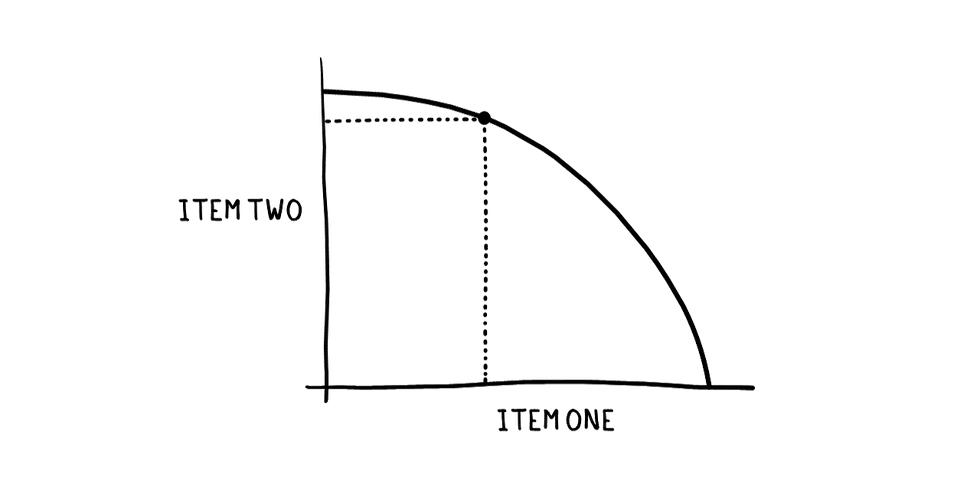

With each pair of goods or services I'm demanding, I have preferences for each of them. That creates a curve that shows me how much of each I can get.

If Item One is concert tickets and Item Two is dinner out, I can afford any combination of tickets and dinners.

This helps us see the trade-offs we have to face - a second popular concept in economics. Economist Thomas Sowell reminds us, "There are no solutions, only trade-offs."

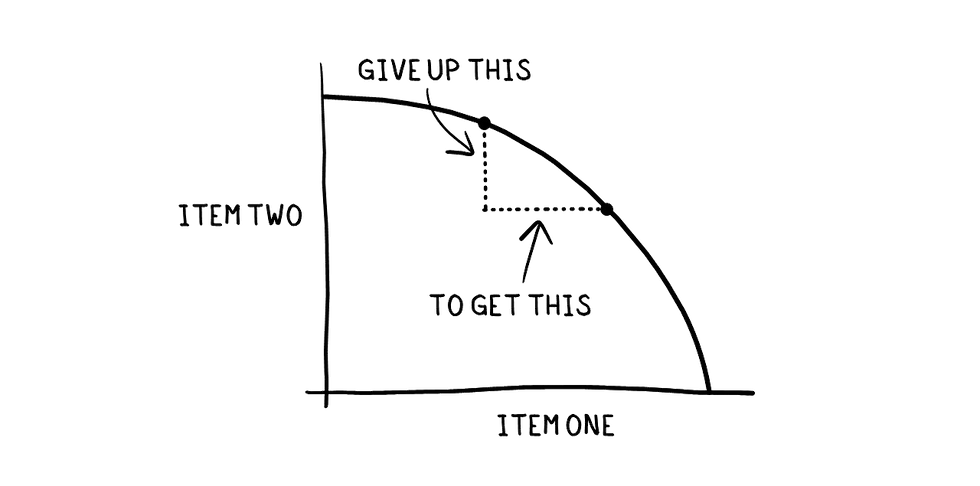

If I want more concert tickets, I have to give up some dinners out.

Trade-offs are at the heart of economics. They remind us that we can have anything we want, but we have to give up something for it. We sometimes have to make some choices.

ADVANCED ECONOMICS TOPICS

Supply and demand, coupled with trade-offs, tell you much of what you need to know about economics (in my opinion, of course).

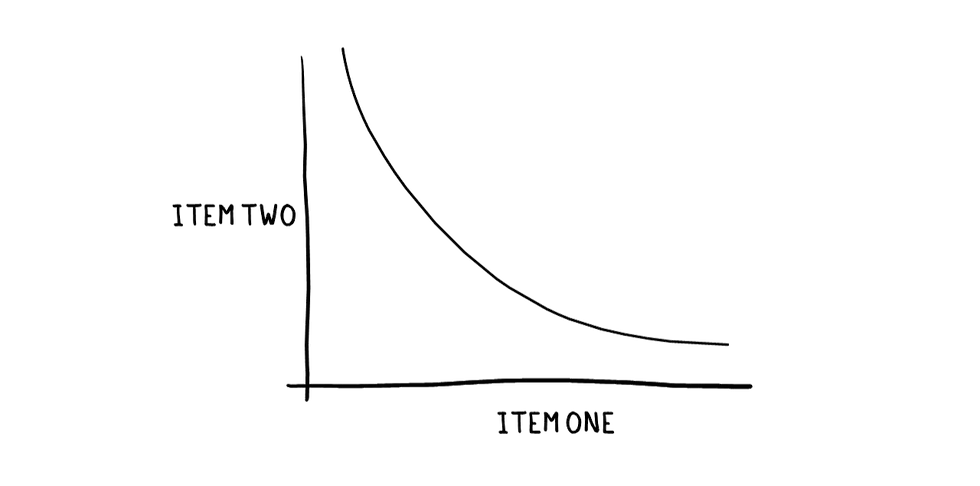

If we want to go a little bit deeper, we can talk about personal preferences. Personal preferences show up in something called indifference curves. An indifference curve shows me the point at which I would be indifferent between two things.

At any point along this curve, I would experience the same satisfaction (or, as economists call it, utility). For example, I might feel equally happy with one concert and ten dinners out as I would one dinner out and five concerts.

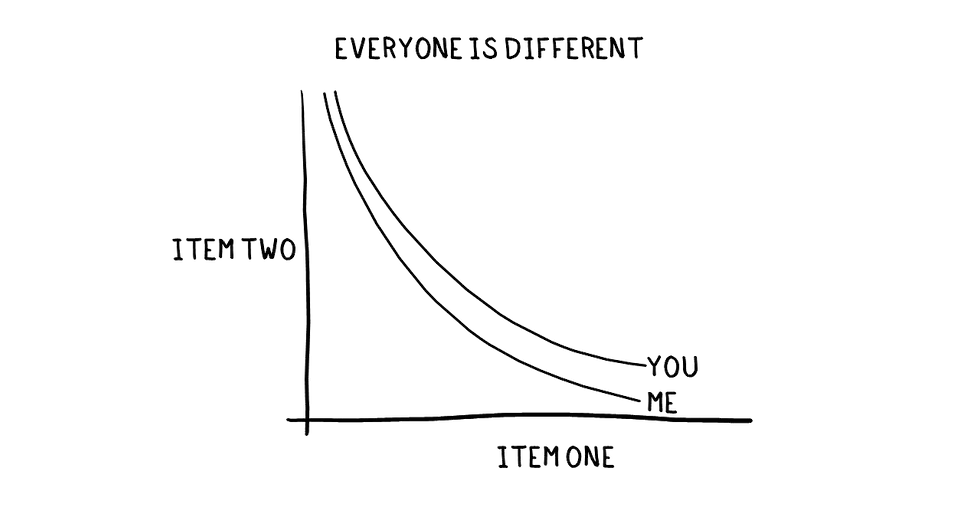

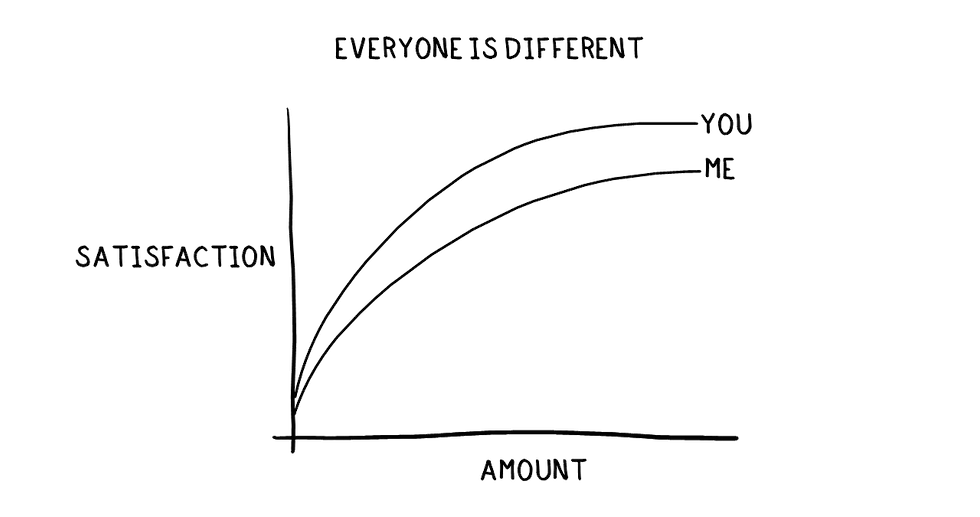

Here's where it gets interesting. Everyone is different. My mix of trade-offs between concerts and dinners is different from yours, which are both different from someone else's.

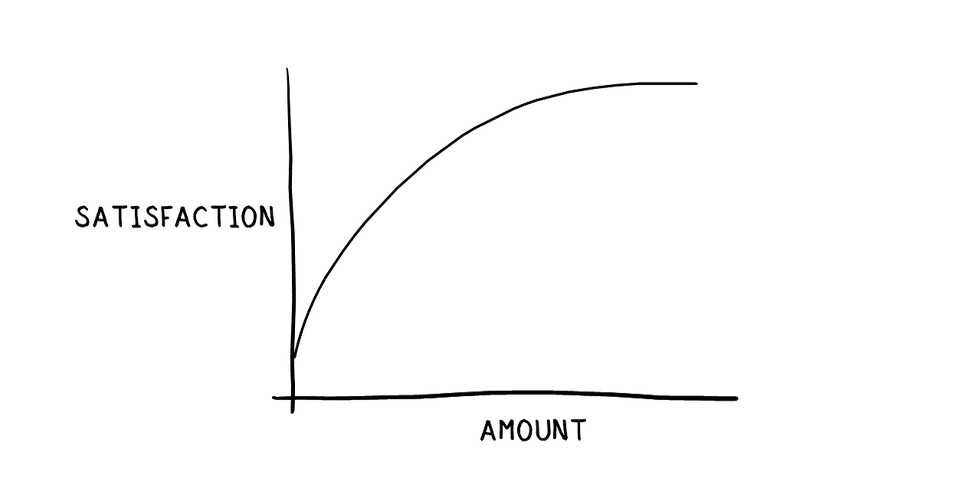

Personal preferences show up in other places, too, like how much satisfaction we get from the amount of each thing we get. This is a utility function (because utility is what economics use to talk about satisfaction).

Generally, these curves tend to go up pretty quickly at first, but it flattens out - a concept called diminishing marginal utility. Basically, it means we get less satisfaction from each additional thing.

Take bites of ice cream as an example. The first few bites of ice cream are amazing. The fifth bite is pretty good. But the extra joy I get when I go from 99 bites to 100 bites is pretty small.

Just as with indifference curves, everyone gets different satisfaction from each additional unit.

|

|

The Five Facet Mindfulness Questionnaire measures your level of mindfulness among five interrelated components. These components are observing, describing, acting with awareness, nonjudgment of inner experiences, and not reactivity to inner experiences. They can be helpful in gaining an understanding of the areas of mindfulness in which you may want to focus. |

|

PERSONAL VALUES

You might ask why this matters; why am I boring you to death with economics speak?

It's because most of us don't know we're making these choices, trade-offs, or decisions. They happen underneath conscious awareness.

If we don't know that we're making these choices, we're running on autopilot. We can't align our use of money if we don't know what we value. So it pays to get to know what we value.

In a perfect world, we'd be able to perfectly overlap our money and our values.

In the real world, we can settle for a good amount of overlap.

Our values are the lens through which we see the world, and acting on them consciously will lead to more life satisfaction.

MINDFULNESS

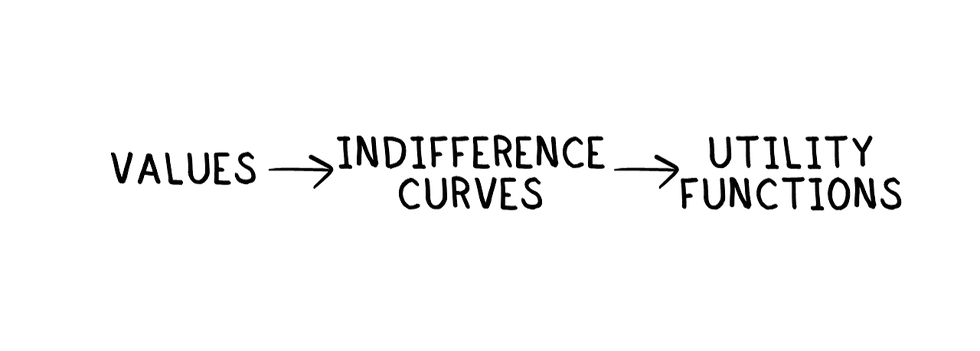

Our values feed into our indifference curves and utility functions, shaping the trade-offs we face and, ultimately, what we supply and demand.

If our values lead to our choices, consciously or unconsciously, what leads to our values?

Our values come from our experience. The values are there whether we know it or not. They work similarly to our money scripts in the sense that we often don't know they are there.

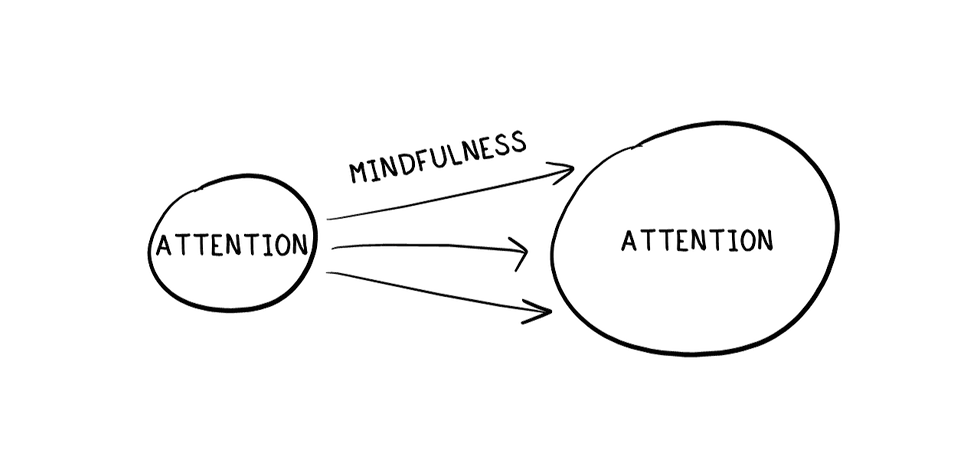

Being more mindful of your values helps you prioritize your time. Mindfulness brings more awareness to your life.

Financial health is part of economics; we just need to be aware of what our priorities and choices actually are. Mindfulness can help bring more attention to our automatic thoughts and behaviors and more in touch with our values.

You get one life; live intentionally.

If you know someone else who would benefit from reading this, please share it with them. Spread the word, if you think there's a word to spread.

To share via text, social media, or email, simply copy and paste the following link:

Subscribe to Meaningful Money

Thanks for reading. If you found value in this article, consider subscribing. Each week I send out a new post with personal stories and simple drawings. It's free, and there's no spam.

REFERENCES AND INFLUENCES

Ariely, Dan: Predictably Irrational Ariely, Dan & Jeff Kreisler: Dollars and Sense Budd, Chris: The Financial Wellbeing Book Clements, Jonathan: How to Think About Money Hagen, Derek: Money’s Purpose in Your Life Hagen, Derek: Your Money, Your Values, and Your Life Hanh, Thich Nhat: You Are Here Hanson, Rick & Richard Mendius: Buddha’s Brain Harris, Dan: 10% Happier Harris, Sam: Waking Up Kabat-Zinn, Jon: Wherever You Go, There You Are Kahneman: Daniel: Thinking Fast and Slow Robin, Vicki: Your Money or Your Life Zweig, Jason: Your Money and Your Brain